BIO President and CEO Jim Greenwood addressed the policies expected to be considered by the Obama Administration and the 111th Congress which will impact the biotechnology industry including health care reform, stem cell research, follow-on biologics, comparative effectiveness and energy security.

Following President Obama address to Congress and the nation, Greenwood released a statement saying:

“We share President Obama’s stated goal of expanding access to health care. We believe biotechnology can play a key role in this quest. Biotechnology can help bring needed innovation to modernize and add efficiencies to our nation’s health care system. Innovation in health care, including health care solutions such as new therapies and diagnostics, has always been and will continue to be central to realizing our health care goals. Further, we believe that market-based reforms provide the best opportunity to achieve the goal of universal access while providing high quality care and incentives for the discovery and development of innovative improvements throughout the health care delivery system.”

Greenwood then discussed the importance of biotech both in the economy and in developing technologies, particularly relating to healthcare and biofuels. A large part of the discussion focused on the expectation that there will be some kind of follow-on biologics rule proposed and the importance of data exclusivity. Not to be confused with patents, data exclusivity is the period after the FDA approves a product during which an imitator can’t rely on the innovator’s clinical data for safety and effectiveness. It can run during and longer than the period of patent protection.

President Obama’s budget, released today, is set to remove barriers to creating generic biologics. The administration is expecting to use the money the federal government would save through use of biogenerics to help pay for a major overhaul of the healthcare system.

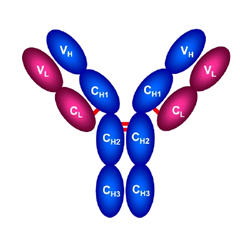

Unlike traditional chemical drug approval, the Food and Drug Administration currently has no process for approving biogenerics, also called “follow-on biologics” and “biosimilars.” Generally, biotech drugs are more complicated than regular drugs because they are made from living cells or bacteria.

For a generic drug manufacturer to win approval of a generic version of a traditional prescription drug, the product must have the same active ingredient, strength, dosage form and route of administration as the original drug. This means that generic drugs are the exact same chemically as their brand name counterparts and they act the same way in the body.

Such a process is not possible with biologics. Biologics manufacturers must ensure that the manufacturing process remains the same over time by controlling the source and nature of starting materials and controlling the manufacturing process. When a follow-on biologic is created, it requires a new manufacturing process with new starting materials. As a result, it will produce a product that is different from and not therapeutically equivalent with that of the brand name biologic.

The generic industry has proposed letting companies copy biologics after three to five years, similar to rules set for conventional drugs under the 1984 Hatch-Waxman Act. The administration’s proposal suggests the time frame would be consistent with Hatch-Waxman, though administration officials could not confirm that last night.

To give you an idea of the impact of these changes, last year the Congressional Budget Office estimated that the federal government would have saved $6.6 billion over 10 years under proposed legislation that would have provided biotech companies 12 years of market exclusivity for new biologic drugs.

But biotechnology companies have fought to keep a monopoly on their drugs for at least 14 years. They say they need that amount of time in order to ensure a return on the significant investment required to develop biologics. Companies also fear patents will not fully protect biologics since competitors could make a similar molecule that may not be covered by the patent.

Greenwood pointed out that in order to preserve incentives to research, develop and manufacture new innovative therapies and cures, as well as new indications for such products, any statutory pathway for follow-on biologics must include substantial non-patent data exclusivity, during which follow-on manufacturers could not rely on FDA’s prior approval of innovative biologics to support approval of their own products.

BIO supports the notion that the longer period is justifiable stating that such data exclusivity is necessary because a follow-on biologic may be similar enough to an innovative biologic for regulatory approval purposes, but different enough to avoid the innovator’s patents. Thus, non-patent exclusivity is necessary to maintain effective market protection. Further, the industry’s heavy dependence on significant amounts of investment capital and the high risks and costs involved in the development of new biologic medicines all warrant a substantial period of exclusivity.

Greenwood stressed that any discussion must recognize that the methods used to show that one chemical drug is the same as another are different from and insufficient for biologics. Thus, versions of a biological product made by different manufacturers must be evaluated on a case-by-case basis, because they will differ from each other in certain respects.

Greenwood also pointed out that mandating a data exclusivity period below 14 years in follow-on biologics legislation would save the federal government at most an additional $1.4 billion over 10 years, a “relatively small savings” for the government’s total health budget. On the other hand, just reducing the exclusivity period from 14 years to 10 years would reduce revenue by 12% for the biotech companies and cause a dramatic drop in R&D spending for biotechs. BIO claims that the average biotechnology company does not cover its costs of a biologic until 17 years after the initial sales of the product.

Recent legislative proposals vary along several dimensions, including differing durations of data exclusivity. Under any new law, a follow-on biologic applicant will be required to demonstrate that there are no clinically meaningful differences in safety, purity and potency between its product and the brand product in order for the FDA to approve a follow-on biologic as interchangeable. However, the applicant must provide evidence that its product will produce the same clinical result as the brand product in any given patient and that it presents no additional safety risks or diminished efficacy if a patient alternates or is switched between products. This will be a tough road to travel.

Biotechnology Industry Statistics

- 120 companies (30%) are now trading with less than 6 months of cash on hand. 180 companies (45%) have less than 1 year of cash remaining.” Only 10% of the 370 public US biotech companies have positive income. (source: BIO)

- By comparison with 2007, funds raised from IPOs in 2008 fell 97% and follow-on/secondary offerings fell 56%. Total capital raised by the industry in 2008 fell by 55% vs 2007 (source: BioCentury).

- In 2006, 32 life sciences companies raised $1.7 billion through IPOs. In 2007, 41 raised $1.9 billion. In 2008, there was only one IPO in the US, which raised $5.8 million. (source: BioWorld) There were 19 biotech IPOs withdrawn in 2008.

- 87% of US biotech stocks have lost value in 2008 with 26% of 350 biotech companies currently trading under $1 Billion in market cap now trading below their cash value. That is, they have more cash on hand per share than the market value of their companies. This level has gone up by 3x vs 2007.(source: BIO).

The podcast is available here.

Related: Congressman Waxman Addresses GPhA Meeting on Follow-on Biologics

Earlier, the

Earlier, the  Arguing that there are too many restrictions being placed on biotech crops, 26 leading corn insect scientists working at public research institutions located in 16 corn producing states

Arguing that there are too many restrictions being placed on biotech crops, 26 leading corn insect scientists working at public research institutions located in 16 corn producing states