OK, maybe not explode but at least some terrible, Armageddon-like fate. According to a study by the Federal Trade Commission, pharmaceutical companies are engaging in anti-competitive tactics of paying potential generic rivals to delay the introduction of lower-cost prescription drug alternatives. The report summarizes data on patent settlements filed with the FTC and the Department of Justice during FY 2011 under the Medicare Modernization Act of 2003.

Here’s the supposed data and the conclusions drawn from them, you be the judge:

The FTC looked at 156 final resolutions of patent disputes between a brand-name and a generic pharmaceutical makers. Out of the 156, they found the following:

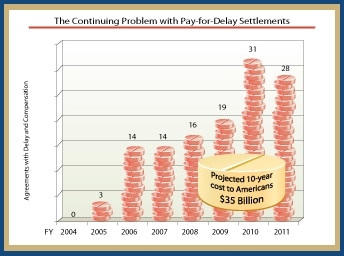

- 28 final settlements contain both compensation to the generic manufacturer and a restriction on the generic manufacturer’s ability to market its product;

- 100 final settlements restrict the generic manufacturer’s ability to market its product, but contain no explicit compensation;

- 28 final settlements have no restrictions on entry; and

- of those 28 final settlements that contain both compensation and a marketing restriction, 18 involved generics that were so-called “first filers,” meaning that they were the first to seek FDA approval to market a generic version of the branded drug, and, at the time of the settlement, were eligible to exclusively market the generic product for 18 months.

So far, so good. Up to this point, these are all just facts. Now, look at the conclusion the FTC draws:

- generic drugs help reduce costs for taxpayer-funded health programs such as Medicare and Medicaid.

- generic drug prices are typically at least 20 to 30 percent less than the name-brand drugs;

- patent settlements that include a payment or other compensation delay generic entry on average by 17 months longer than those that do not include a payment;

- the 28 settlements involve 25 different branded pharmaceutical products with combined annual U.S. sales of more than $9 billion; and

- prohibiting pay-for-delay settlements would reduce the federal deficit by $2.67 billion over 10 years.

Ipso facto, pay-for-delay settlements are at the root of the world financial crisis. And global warming. And maybe the war on Christmas. Well, at least we know the government knows how to work a calculator. What they lack (purposefully?) is an understanding that patent lawsuit settlements by there very nature are two sides coming up with terms that they can both agree on.

Both sides are for-profit entities with no interest in not making a profit. Both sides are also being advised by presumably competent counsel. The brand-name company believes its patent is perfectly valid but aware that anything can happen in litigation. The generic company may well believe the patent is not valid but aware that anything can happen in litigation. They have weighed the risks and rewards and decided on a settlement they can live with.

Yet, the FTC concludes that these settlement are wrong and are harming hard-working, God-fearing Americans. Or, is it that the government really just needs to reduce the deficit and cutting drug costs sounds good?

“While a lot of companies don’t engage in pay-for-delay settlements, the ones that do increase prescription drug costs for consumers and the government each year,” said FTC Chairman Jon Leibowitz. “Fortunately, Congress has the opportunity to fix this problem through the Joint Select Committee on Deficit Reduction — and save the government and American taxpayers billions of dollars.”

The FTC has challenged a number of these patent settlement agreements in court, contending that they are anti-competitive and violate U.S. antitrust laws. The agency also has supported legislation in Congress that would prohibit pay-for-delay settlements that increase the cost of prescription drugs.

Inevitably, the FTC must make some difficult decisions about whether or not a particular patent settlement harms competition and should be challenged on antitrust grounds. But the broad conclusion that a settlement is anti-competitive if it includes compensation plus market restriction lacks a proper critical analysis.

At least you can like the FTC on Facebook.

Nobody is claiming the settlements are forced or otherwise invalid. The problem is that the settlements are blatant violations of antitrust laws — a bigger market player is paying a smaller market player for the express purpose of limiting competition.

[…] US: FTC Issues FY 2011 patent settlement report; attempts to keep up the heat on passage of the Preserve Access to Affordable Generics Act (FDA Law Blog) (Patent Docs) (Patent Baristas) […]

+1 @Max

The author forgets that the basis of the property in the settlement was granted on behalf of the American public in exchange for full disclosure and enablement back to the public.

The formula could be simple: Has the time elapsed? Did the inventor come up with any non-obvious innovation? If the answers are yes and no, then the generic should be manufactured and sold without threat of litigation. Otherwise, let them sue and settle because the subject of the litigation still exists (the term of exclusivity) and parties can contract as they please, within the law. I applaud the FTC for finally (maybe) getting around to doing the job they are paid for

It is hard to say goodbye to a cash cow, but it was never really owned,

only rented by the USPTO. <<— that could be a country song for nerds