A whopping $1.5 billion went into 102 biotech deals, the single largest investment in a sector, unseating software as king of the venture pot. Medical device deals set a record of $1.08 billion for 96 deals, a 60 percent increase from the amount of funding in the fourth quarter of 2006. The study highlights the fact that an aging population will bring a resulting increase in interest in both medical devices and and biotech research.

Later Stage investing also jumped in the quarter to the highest dollar level since the fourth quarter of 2000 reflecting the fact that biotech and medical device companies require a substantial amount of capital to get through the regulatory process.

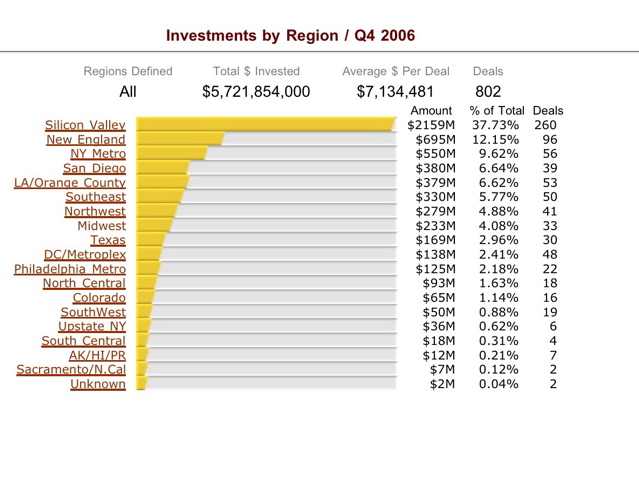

Not everybody saw the quarter as a gold rush. Funding dollars for Seed and Early Stage companies declined 30 percent in Q1 to $1.1 billion in 259 companies, a 26 percent decline in deals. Although, the overall spread showed that Seed/Early Stage companies accounted for 33 percent of the deal volume; Expansion Stage for 35 percent; and Later Stage for 32 percent. The results were also skewed geographically with all of the Midwest receiving $233 million (4.08%) compared to the $2.16 billion (37.73%) going to Silicon Valley alone.

The survey excludes debt, buyouts, recapitalizations, secondary purchases, IPOs, investments in public companies such as PIPES (private investments in public entities), investments for which the proceeds are primarily intended for acquisition such as roll-ups, change of ownership, and other forms of private equity that do not involve cash such as services-in-kind and venture leasing. See the report at MoneyTree Report.